Choose The Right Agent

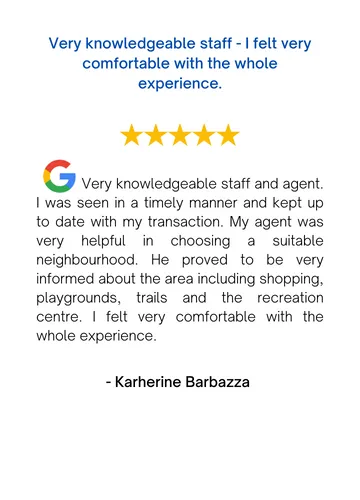

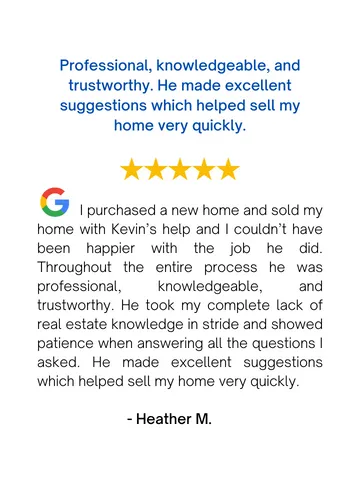

Feedback From Our Previous Clients

9 Years in a Row

Chosen as one of the Top 3 Agents 9 Years in a Row. ThreeBestRated's 50-Point Inspection includes extensive checking of customer reviews, ratings, reputation, history, satisfaction, trust and

general excellence.

About Kevin Flaherty

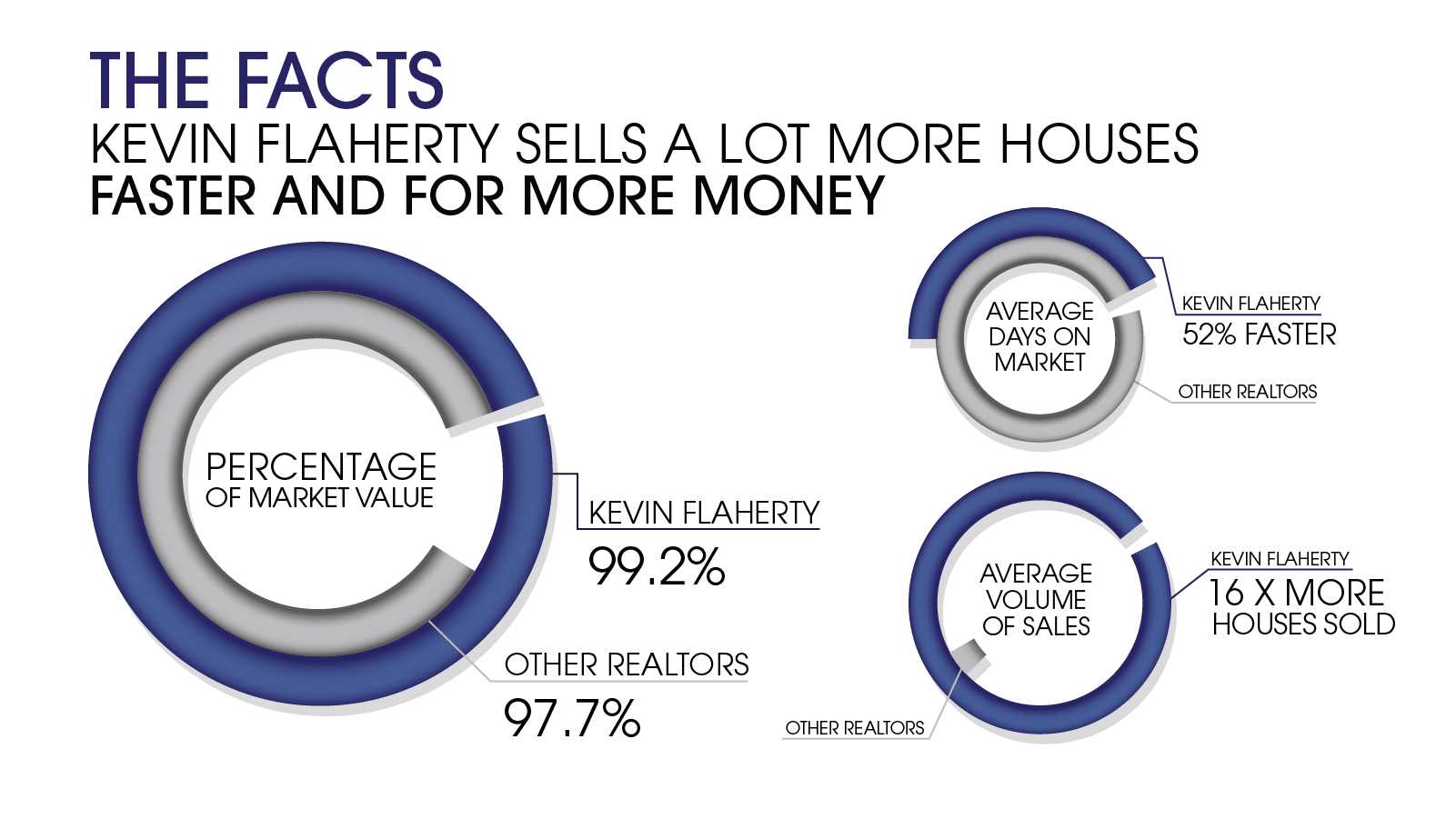

After having been the overall #1 top producing agent in his company for 10 straight years based gross sales over 1,800+ other agents, Kevin went on to become a 2 Time ICON Broker with eXp Realty (eXp’s highest production award). Kevin provides his clients the knowledge & experience that comes with

Over 3 decades in the real estate industry

Thousands of successful real estate transactions

Over half a Billion in real estate sales

For SELLERS

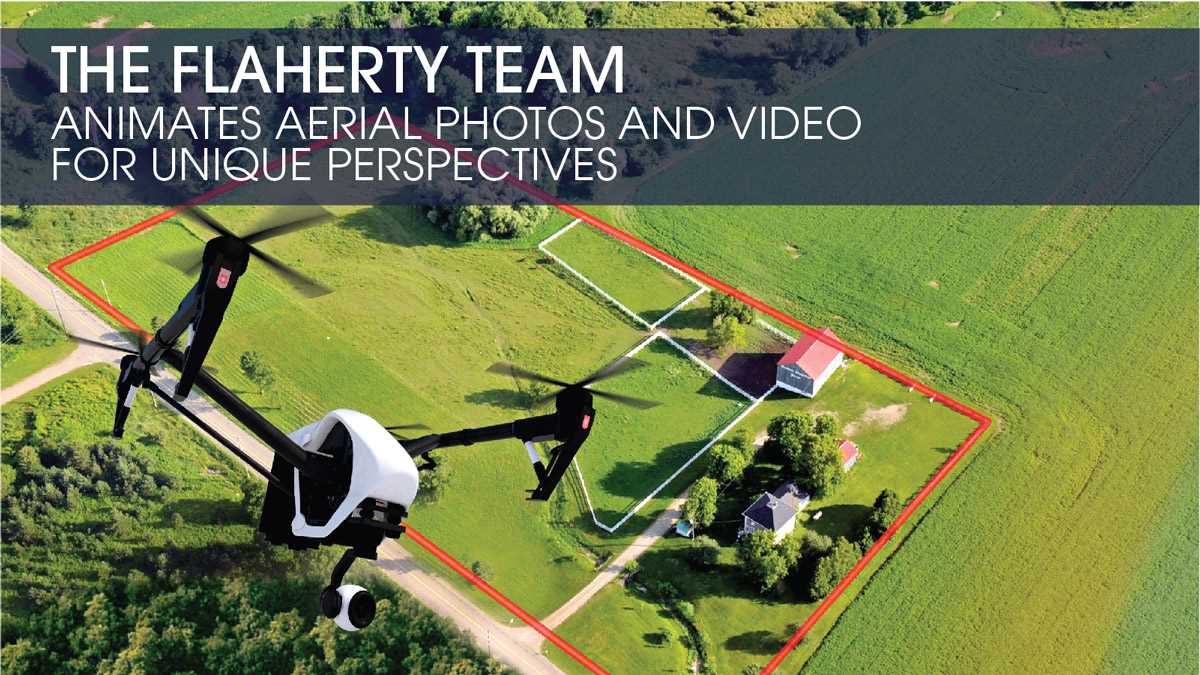

Kevin’s exclusive “Home Selling System Team” maximizes the digital exposure of your home utilizing VR animated online showings to create more awareness with the right buyers so you can sell your home faster and for top dollar.

Learn more at 👉 https://Flaherty.ca/sellers

For BUYERS

Kevin’s 30+ years of real estate experience gives you an unfair advantage when looking, evaluating, selecting and negotiating on every purchase.

Learn more at 👉 https://Flaherty.ca/buyers

For REAL ESTATE AGENTS

Honey Badgers Metaverse is the most EXPERIENCED & ADVANCED Global group of REALTORS® with a disruptive real estate brokerage sharing cutting-edge tools, strategies & best practices to help Agents, Teams & Brokerages grow their business.

PLUS…Things no one else in Real Estate are doing!

***HONEY BADGERS - OUR GROUP IS ALWAYS 100% FREE***

LEARN MORE 👉 https://HoneyBadgerAgents.ca

Choose The Right Agent

Feedback From Our Previous Clients

10 Years in a Row!

Chosen as one of the Top 3 Agents 10 Years in a Row. ThreeBestRated's 50-Point Inspection includes extensive checking of customer reviews, ratings, reputation, history, satisfaction, trust and

general excellence.

Top Listings In Your Area

Select your area below for quick access to a selection of the best properties currently for sale

10 Questions to Ask Before You Hire A Realtor

25 Tips You Should Know To Get Your Home Sold Fast & For Top Dollar

When is the Best Time to Sell My House

Why Didn't My House Sell?

How to Avoid Legal Mistakes When Selling Your House

The #1 Mistake When Placing Your House On MLS

Get Instant Updates on New Listings Matching Your Exact Search Criteria in 3 Easy Steps FREE.

①

②

③

It Takes Less Than 1 Minute!

About Kevin Flaherty

After having been the overall #1 top producing agent in his company for 10 straight years based gross sales over 1,800+ other agents, Kevin went on to become a 2 Time ICON Broker with eXp Realty (eXp’s highest production award).

Kevin provides his clients the knowledge & experience that comes with;

Over 3 decades in the real estate industry

Thousands of successful real estate transactions

Over half a Billion in real estate sales

For Sellers

Kevin’s exclusive “Home Selling System Team” maximizes the digital exposure of your home utilizing VR animated online showings to create more awareness with the right buyers so you can sell your home faster and for top dollar.

Learn more at 👉 https://Flaherty.ca/sellers

For Buyers

Kevin’s 30+ years of real estate experience gives you an unfair advantage when looking, evaluating, selecting and negotiating on every purchase.

Learn more at 👉 https://Flaherty.ca/buyers

For Real Estate Agents

Honey Badgers Metaverse is the most EXPERIENCED & ADVANCED Global group of REALTORS® with a disruptive real estate brokerage sharing cutting-edge tools, strategies & best practices to help Agents, Teams & Brokerages grow their business.

PLUS…Things no one else in Real Estate are doing!

***HONEY BADGERS - OUR GROUP IS ALWAYS 100% FREE***

LEARN MORE 👉 https://HoneyBadgerAgents.ca

Reach Out & Connect With Us!

A HoneyCombHub.ca Web Site Solution

Copyright 2024 . All rights reserved.